Cons of leasing solar panels.

Average monthly lease payment for solar panels.

Pay little or nothing and save hundreds of dollars per year on average.

The monthly payments for most solar leases and ppas increase at a predetermined rate of 1 to 3 percent annually while solar loans typically have fixed monthly payments.

If you re more inclined to play the odds consider a ppa.

With little to no down payment for leasing this could be a good option for a cash strapped individual or business with little to no down payment for leasing this could be a good option for a cash strapped individual or business.

Since utility scale solar leases have terms from anywhere between 15 and 50 years accounting for extensions built in annual rent escalation is the standard.

However if the solar panels do not produce enough energy to cover all of your electricity usage you will have both a solar lease payment and an electric bill.

In most cases your monthly bill will rise or fall with the amount of power your system produces.

Solar lease ppa advantages.

You pay a fixed price per kwh for power generated by the system.

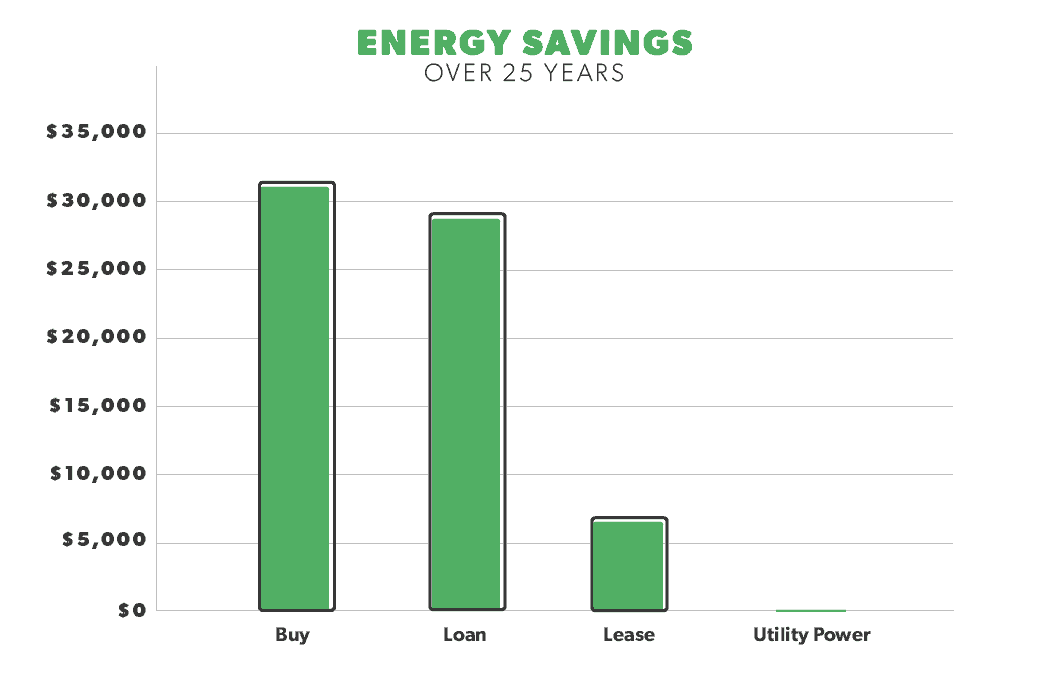

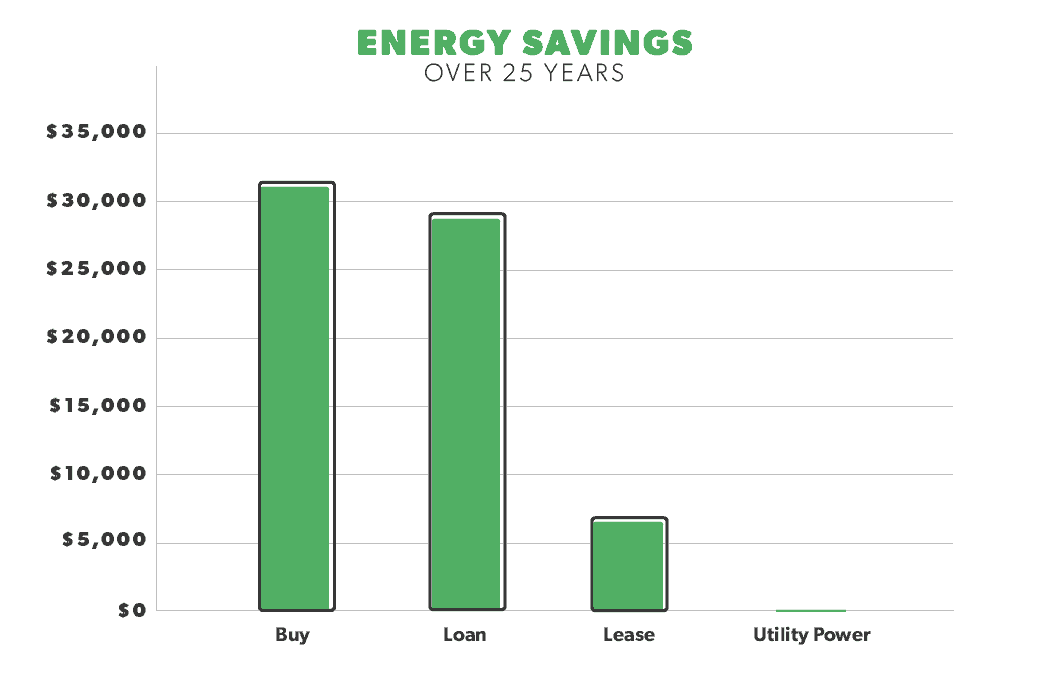

The monthly payments for a 20 year solar loan are likely to be lower than those of a 20 year lease or ppa.

You pay a fixed monthly amount to use the energy generated by the solar system on your roof.

Rates should be near estimates of future inflation with average figures between 1 5 to 2 5 annually.

No interest deductions on your future income tax returns.

The payment will be lower than what your monthly electric bill was before installing solar meaning you will still see long term savings when you lease solar panels.

Solar leases require you to be contractually bound to making monthly payments throughout the entire rental term 20 25 years with minimal monetary gains when the lease is up.

That amount is then divided into consistent monthly payments for the term of your lease.

The average cost of leasing solar panels runs anywhere from 50 250 per month.

How much lower depends on whether your solar loan is secured or.